Leasing is very similar to renting.

You choose a vehicle, for an agreed length of time (usually between 2 and 4 years) and a number of miles (for example 10,000 per year). You pay a fixed monthly cost and at the end of your lease, the car is collected and your payments end.

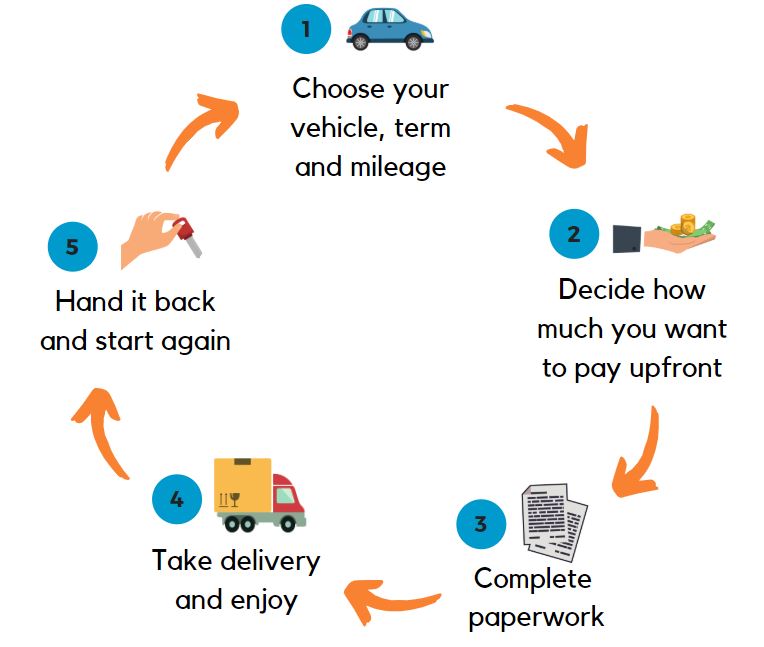

How does leasing work?

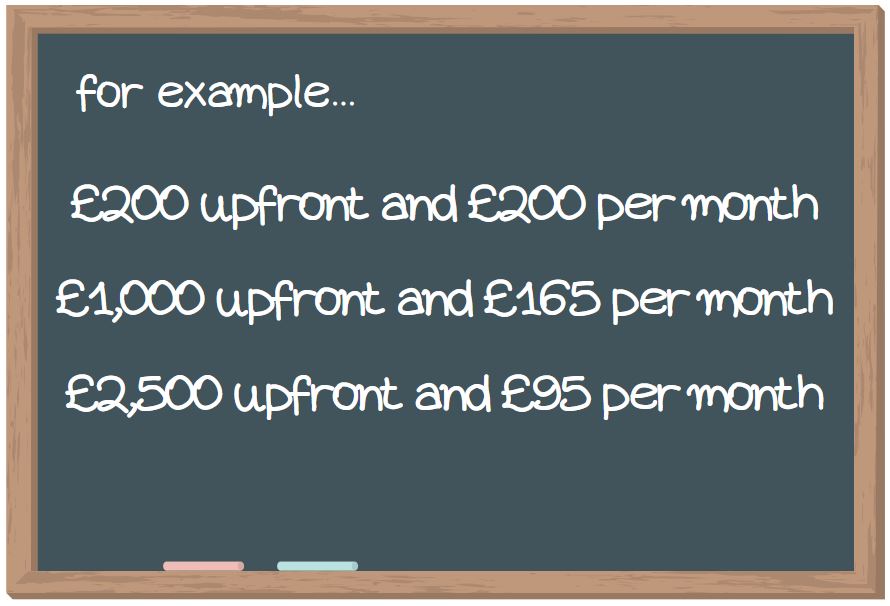

Once you’ve decided on those, you’ll then decide how much you pay upfront (this is what’s known as the initial rental). It can be as much (or as little) as you want and the remainder of the cost is what you pay monthly for the duration of your lease. Of course, this does mean the more you pay upfront, the less you pay per month, and vice versa.

At the end of the lease, when the vehicle is collected, it’ll be checked over. If you go over the agreed mileage, you simply pay the pence per mile charge which you’ll be given at the start of your lease. There is also a charge if you damage the vehicle beyond fair wear and tear.

Why lease?

Leasing is a great way to keep motoring costs fixed and simple. For example, all leases include road tax for the duration and as the vehicles are brand new, they come with a warranty for at least 3 years and breakdown cover for at lease one. You can also include a maintenance package, which covers all of the servicing and tire costs.

Insurance

Leased vehicles have to be insured under a fully-comprehensive policy and you need to let your insurance provider know it’s a lease car. As it’s become extremely popular in recent years, most insurers give you the option to select lease vehicle under the ownership section when getting a quote.

The lease holder does not have to be the policy holder either, they just need to be named on the insurance. So you could lease the vehicle and your spouse could take out the insurance, just as long as you’re a named driver on the policy. With most insurers, it won’t affect your insurance premium either!

Pros

- Leased vehicles can be driven abroad

- You can put a private registration on the vehicle

- If the car depreciates more then expected your payments do not change

Cons

- You cannot buy the vehicle at the end

- You’ll have to pay to end the agreement early

If you want a guide that goes into a bit more depth, check out our full personal leasing guide here and full business leasing guide here, or browse all of our guides here, or just get in touch below.